Relationship Between Variances, Disposing of Variances

In this section, we’ll focus on the direct materials and direct labor variances. Watch this video featuring a professor of accounting walking through the steps involved in calculating a material price variance and a material quantity variance to learn more. A favorable variance may indicate to the management of a company that its business is doing well and operating efficiently. As a company grows, it may have learned ways to produce more without a need to increase its expenses, resulting in a higher revenue stream. However, a favorable variance may indicate that production expectations were not realistic in the first place, which is more likely if the company is new.

What is the Direct Material Variance?

The material yield variance for March was favorable because company actually produced 32,340 tons of output which was higher than the standard output of 31,000 tons based on input quantity of 34,100 tons. Ideally, as a small business owner, you would hope a financial analysis will accounting definition result in a favorable or positive variance, meaning you are not exceeding your budget. However, that does not mean a negative variance may be unexpected for your quarter or year end. Perhaps sales have been suffering lately and your product is piling up and you need a new plan.

Module 10: Cost Variance Analysis

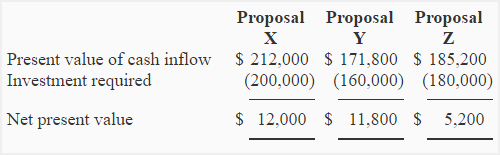

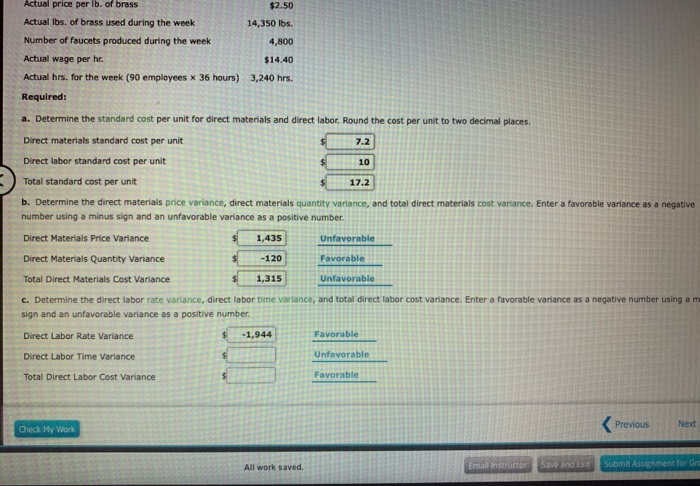

- The net direct materials cost variance is still $1,320 (unfavorable), but this additional analysis shows how the quantity and price differences contributed to the overall variance.

- This comparison helps businesses understand whether they are spending more or less than anticipated on raw materials.

- Note 10.26 “Business in Action 10.2” illustrates just howimportant it is to track direct materials variances accurately.

- In other words, the balance sheet will report the standard cost of $10,000 plus the price variance of $3,500.

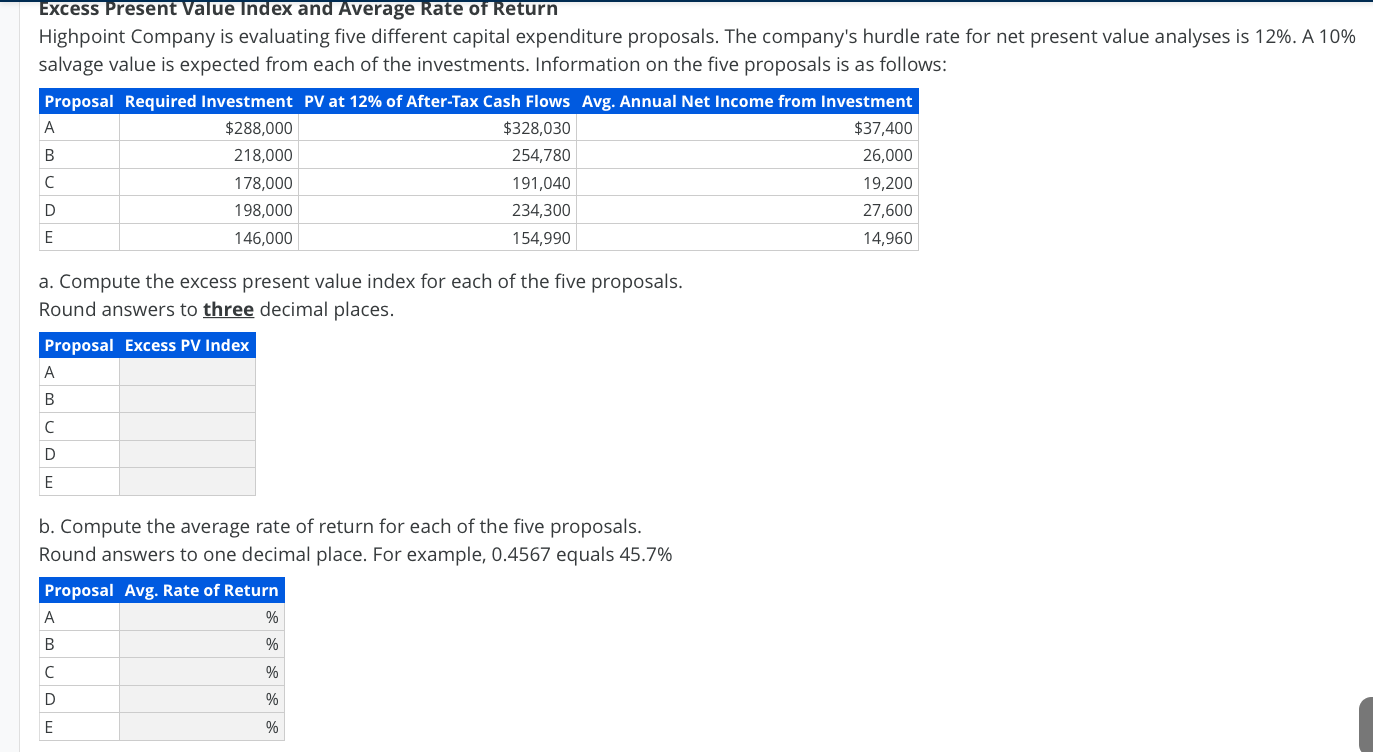

Building strong relationships with suppliers and regularly evaluating their performance can help businesses anticipate and address potential problems before they impact production. It’s important to note that direct material variance can be broken down into more specific components, such as price and quantity variances. However, the initial calculation provides a broad overview that can guide more detailed analysis. By regularly monitoring these variances, businesses can quickly identify trends or anomalies that may indicate underlying issues, such as supplier problems or inefficiencies in the production process. For Boulevard Blanks, let’s assume that the standard cost of lumber is set at $6 per board foot and the standard quantity for each blank is four board feet.

Clarification of Favorable Versus Unfavorable

As a result of this unfavorable outcome information, the company may consider retraining workers to reduce waste or change their production process to decrease materials needs per box. The difference in the quantity is multiplied by the standard price to determine that there was a $1,200 favorable direct materials quantity variance. This is offset by a larger unfavorable direct materials price variance of $2,520.

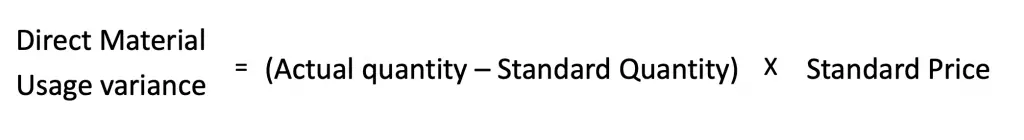

A favorable outcome means you used fewer materials than anticipated, to make the actual number of production units. If, however, the actual quantity of materials used is greater than the standard quantity used at the actual production output level, the variance will be unfavorable. An unfavorable outcome means you used more materials than anticipated to make the actual number of production units. The amount by which actual cost differs from standard cost is called a variance. When actual costs are less than the standard cost, a cost variance is favorable. When actual costs exceed the standard costs, a cost variance is unfavorable.

However, do not automatically equate favorable and unfavorable variances with good and bad. For instance, a favorable raw materials cost variance may indicate that a purchasing manager, under pressure to meet financial goals, is buying inferior (cheap) goods. If a company’s actual quantity used exceeds the standard allowed, then the direct materials quantity variance will be unfavorable. This means that the company has utilized more materials than expected and may have paid extra in materials cost. The direct materials quantity variance of Blue Sky Company, as calculated above, is favorable because the actual quantity of materials used is less than the standard quantity allowed.

These two pieces of information are important to consider when analyzing the variance between expected and actual material costs. The actual quantity used can differ from the standard quantity because of improved efficiencies in production, carelessness or inefficiencies in production, or poor estimation when creating the standard usage. Knowledge of this variance may prompt a company’s management team to increase product prices, use substitute materials, or find other offsetting sources of cost reduction. If $2,000 is an insignificant amount relative to a company’s net income, the entire $2,000 unfavorable variance can be added to the cost of goods sold.

The combination of the two variances can produce one overall total direct materials cost variance. The producer must be aware that the difference between what it expects to happen and what actually happens will affect all of the goods produced using these particular materials. Therefore, the sooner management is aware of a problem, the sooner they can fix it. For that reason, the material price variance is computed at the time of purchase and not when the material is used in production.

Connie’s Candy paid $2.00 per pound more for materials than expected and used 0.25 pounds more of materials than expected to make one box of candy. In a movie theater, management uses standards to determine if the proper amount of butter is being used on the popcorn. They train the employees to put two tablespoons of butter on each bag of popcorn, so total butter usage is based on the number of bags of popcorn sold. Therefore, if the theater sells 300 bags of popcorn with two tablespoons of butter on each, the total amount of butter that should be used is 600 tablespoons. Management can then compare the predicted use of 600 tablespoons of butter to the actual amount used.

If the actual usage of butter was less than 600, customers may not be happy, because they may feel that they did not get enough butter. If more than 600 tablespoons of butter were used, management would investigate to determine why. Some reasons why more butter was used than expected (unfavorable outcome) would be because of inexperienced workers pouring too much, or the standard was set too low, producing unrealistic expectations that do not satisfy customers. Let’s assume that the Direct Materials Usage Variance account has a debit balance of $2,000 at the end of the accounting year.

In this case, the actual price per unit of materials is $6.00, the standard price per unit of materials is $7.00, and the actual quantity used is 0.25 pounds. Because of the cost principle, the financial statements for DenimWorks report the company’s actual cost. In other words, the balance sheet will report the standard cost of $10,000 plus the price variance of $3,500.