In this section, we’ll focus on the direct materials and direct labor variances. Watch this video featuring a professor of accounting walking through the steps involved in calculating a material

Furthermore, it assumes immediate reinvestment of the cash generated by projects being analyzed. This assumption might not always be appropriate due to changing economic conditions. Investors assess the level of risk of an investment and then determine a rate of return that would make the investment worth their while, called the risk-adjusted discount rate. The higher the risk, the higher the required rate of return, and thus, the higher the discount rate. Remember, the discount rate isn’t a fixed number, but a measure of the opportunity cost of capital and a reflection of the perceived risk.

Steps to Calculate Net Present Value

This is because of the potential earnings that could be generated if the money were invested or saved. The present value is calculated to be ($30,695.66) since you would need to put this amount into your account; it is considered to be a cash outflow, and so shows as a negative. If the future value is shown as an outflow, then Excel will show the present value as an inflow. You can also incorporate the potential effects of inflation into the present value formula by using what’s known as the real interest rate rather than the nominal interest rate.

How to Calculate Present Value (Detailed Examples Included)

The time value of money (TVM) principle, which states that a dollar received today is worth more than a dollar received on a future date. In the context of pension obligations, present value is also an invaluable tool. It helps in estimating the current worth of the future pension payments an organization is obligated to make. This enables organizations to adequately fund their pension schemes and ensure they meet their future obligations. Similarly, an increase in the number of periods (n) reduces the present value.

What are the capital budgeting sums?

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- Net present value is a financial calculation used to determine the present value of future cash flows.

- This concept is the foundation of NPV calculations, as it emphasizes the importance of considering the timing and magnitude of cash flows when evaluating investment opportunities.

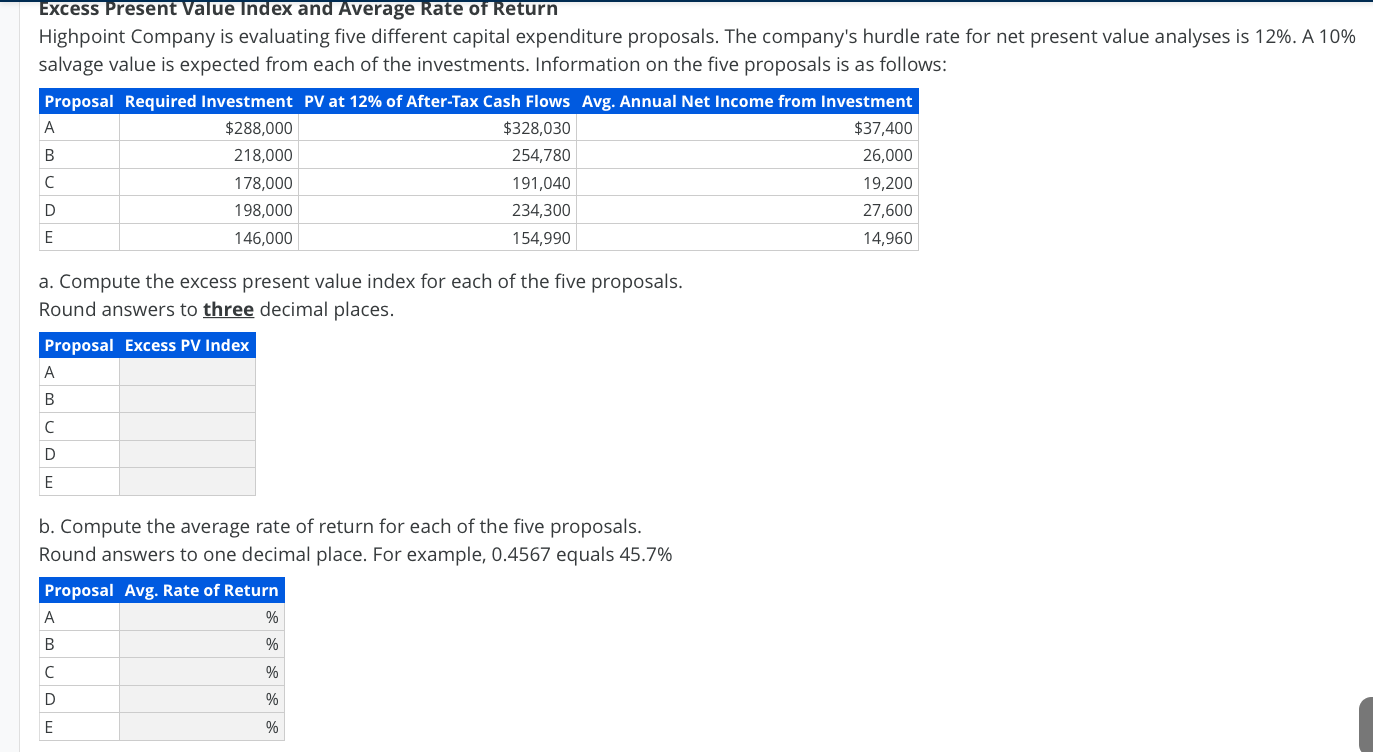

The higher the positive NPV, the more profitable the investment or project is likely to be. According to the rate of return on investment (ROI) method, Machine B is preferred due to the higher ROI rate. The Excess Present Value Index can be a powerful tool for assessing investments and financial decisions, provided it is applied correctly. The excess present value index is flexible enough to be applied to different types of investments or scenarios, making it a useful tool for assessing all sorts of financial decisions.

Capital Budgeting: Important Problems and Solutions

In this case, decision-makers should consider alternative investments or projects with higher NPVs. This concept is the foundation of NPV calculations, as it emphasizes the importance of considering the timing and magnitude of cash flows when evaluating investment opportunities. The EPV can be used to make more accurate decisions when assessing investments and financial decisions, allowing for more informed decision-making. Additionally, it allows for the comparison of different investment options in terms of their present value.

How to Calculate Present Value

Understanding the potential role of present value in CSR activities provides valuable insights into the financial commitments companies make towards sustainability. To fully understand the idea of present value, one must first grasp the underlying principle of the time value of money (TVM). A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

If you expect to have $50,000 in your bank account 10 years from now, with the interest rate at 5%, you can figure out the amount that would be invested today to achieve this. A higher present value is better than a lower one when assessing similar investments. For example, $1,000 today should be worth more than $1,000 five years from now because today’s $1,000 can be invested for those five years and earn a return. If, let’s say, the $1,000 earns 5% a year, compounded annually, it will be worth about $1,276 in five years. In this case, the PVI of 0.95 means the NPV is negative and managers should reject this project.

Remember this when drawing conclusions from the PVI if you’re comparing investments of largely different sizes. The present value index (PVI) is a measure of the attractiveness of a project or investment.

The time value of money is a fundamental concept in finance, which suggests that a dollar received today is worth more than a dollar received in the future. TVM is a concept that suggests money available in the present like-kind exchange time is worth more than the same amount in the future. This value difference stems from the potential of the present money to earn returns or income through investments, interests, or other financial avenues.